best books on avoiding taxes

JJ Monte Author 10 out of 5 stars. Current price is 1495 Original price is 1695.

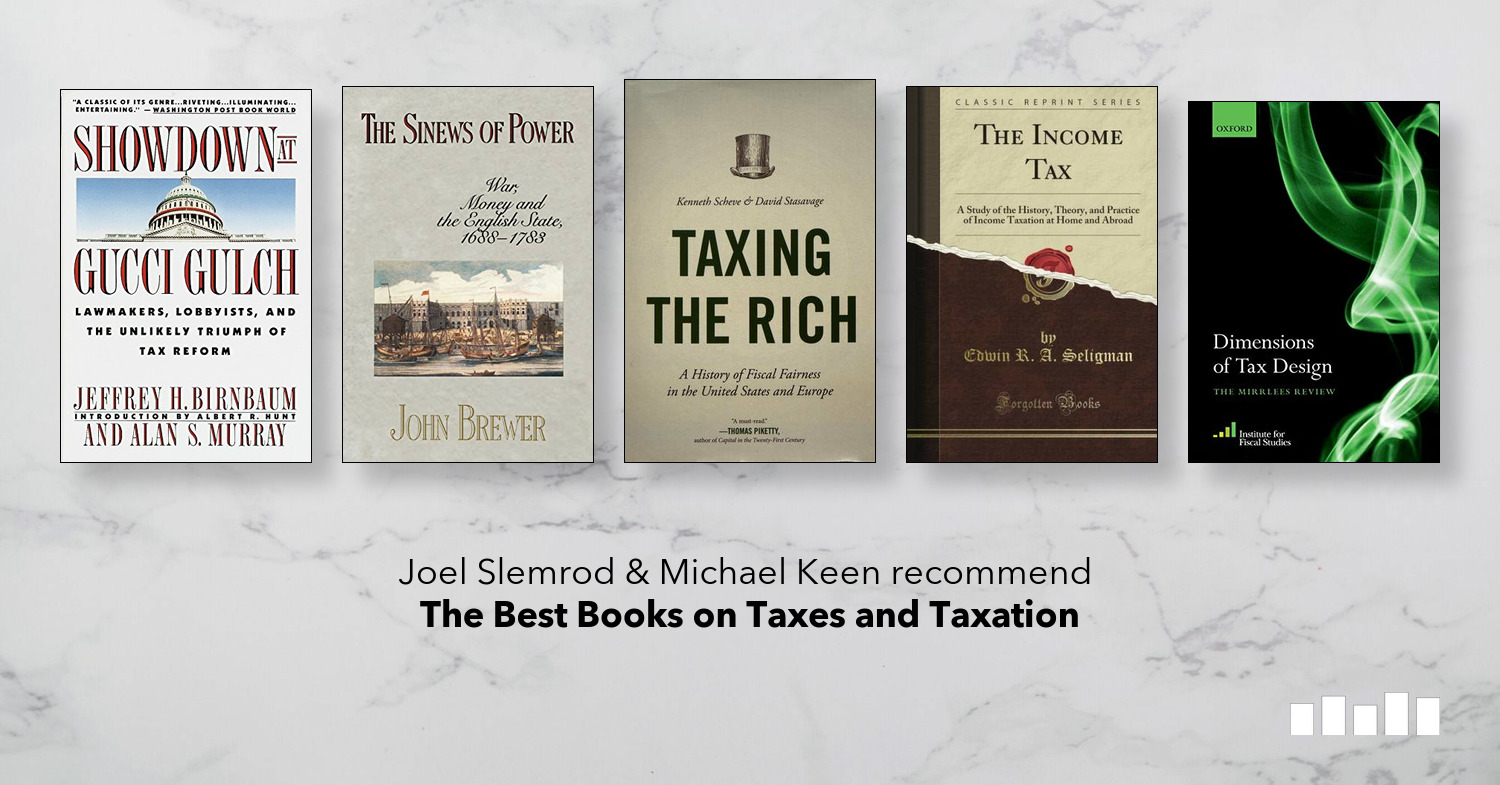

The Best Books On Tax Five Books Expert Recommendations

Booktopia has How to Legally Reduce Your Tax Without Losing Any Money.

. This book answers the leading tax and legal questions facing small business owners across all stages. And in the case of Testementary Trusts if you have kids maximise any life insurance tax benefits should you die just for starters. Certified Public Accountant this book is written for the small business owner or self-employed professional.

Biggerpockets also came out with a book a couple years ago written by Amanda Han. The government assesses a 153 Federal Insurance Contributions Act tax on all earnings to pay for the Social Security and Medicare programs. Toward Tax Reform That Mirrors Our Better Selves Hardcover by.

Small business owners looking for answers to specific questions should check out The Tax and Legal Playbook written by CPA and Attorney Mark J. Tax deductions reduce the amount of taxable income you can claim and tax credits reduce the tax you owe and in many cases result in a nice refund. Flip to back Flip to front.

Our Selfish Tax Laws. Best books on avoiding taxes. Pay yourself an interest-free wage.

How To Avoid Paying Taxes Legally Paperback August 7 2013. Booktopia has How to Legally Reduce Your Tax Without Losing Any Money. Qualify For Tax Credits.

Best for Basics. He wrote The Book on Rental Property Investing and this handy guide explains everything you need to know about. Lassers 1001 Deductions and Tax Breaks Buy on Amazon This book is an excellent place to start if you dont know the first thing about taxes.

Channel wages through a nominal corporation. Reduce your income taxes. Answer 1 of 4.

Small Time Operator. 1 of 5 stars 2 of 5 stars 3 of 5 stars 4 of 5 stars 5 of 5 stars. In addition to creating additional income a side business offers many tax advantages.

Find all the books read about the author and more. Companies and Trusts give you the vehicles to place assets into to minimise tax and reduce litigation liabilities. Your Living Trust Estate.

Best books on avoiding taxes Thursday March 24 2022 Edit Economic system offers no shortage of loopholes allowing the ultra-rich to shortchange Uncle Sam. Middle class welfare Govt. I read Constitutional Income Do You Have Any by Phil Hart and also Cracking the Code by Peter Hendrickson.

Capital losses in excess of 3000 can be carried forward to later tax years. Authored by a CPA. Larsen Bruce Trimble Zachary M.

Mitt Romney claimed the management fee of his corporation as a capital gain rather than income reducing his tax rate significantly. Infanti Goodreads Author shelved 2 times as taxation avg rating 300. Start filing for free online now.

Capital Gains Minimal Taxes The Essential Guide For Investors And. 6 Ways To Avoid Taxes Like a Millionaire 6 Ways To Avoid Taxes Like a Millionaire By Carolyn Bigda Daniel Bortz Elaine Pofeldt and Penelope Wang. The Tax and Legal Playbook.

Taxmanns Bare Act Rules and kanga palkhiwalas The law and Practice of Income Tax a commentary. Game-Changing Solutions to Your Small-Business Questions. GoCurryCracker and MadFientist had some great posts on minimizing taxes like this one.

The Book on Rental Property Investing. Many people dont realize that a tax credit is the equivalent of free money. Paused Youre listening to a sample of the Audible audio edition.

See search results for this author. A Concise Guide to Taxes in Retirement. Buy How To Avoid Paying Taxes Legally CJ3 by Curtis Don Monte JJ ISBN.

How to Start Your Own Business Keep Your Books Pay Your Taxes and Stay Out of Trouble. Answer 1 of 8. Buy a discounted Paperback of How to Legally Reduce Your Tax online from Australias leading online bookstore.

Deduct Half of Your Self-Employment Taxes. Kick It Down the Road. By Don Curtis Author JJ Monte Author Visit Amazons JJ Monte Page.

I also examined both sides of the controversy about Hendrickson as he has been called a Tax Protestor for his book which doesnt really make any protests but ra. Yet this year google which made 55 billion in revenues only paid an effective tax rate of 24.

Top 23 Best Small Business Taxes Books Of 2022 Reviews Findthisbest

Treasure Islands Uncovering The Damage Of Offshore Banking And Tax Havens By Nicholas Shaxson

Top 10 Ways To Avoid Taxes A Guide To Wealth Accumulation By Mark J Quann Bowker Wealth Money Book Tax

25 Best International Taxes Books Of All Time Bookauthority

Everyone Talks About How Great Hsa S Health Savings Plans Are But How Do You Contribute To Them Personal Finance Bloggers Finance Bloggers Personal Finance

How To Avoid The 30 Tax Withholding For Non Us Self Publishers Thinkmaverick My Personal Journey Through Psychology Books Technology Life Book Publishing

The Best Books On Tax Five Books Expert Recommendations

Amazon Best Sellers Best Personal Taxes

The Best Books On Tax Five Books Expert Recommendations

The Triumph Of Injustice How The Rich Dodge Taxes And How To Make Them Pay By Emmanuel Saez

Amazon Best Sellers Best Personal Taxes

The Complete Book Of Wills Estates Trusts By Alexander Https Www Amazon Com Dp 0805078886 Ref Cm Sw R Pi Dp X W C3yb Discount Books Books Save Yourself

The Best Books On Tax Five Books Expert Recommendations

The Best Books On Tax Five Books Expert Recommendations

Pin By Jyn Erso On Great Ideas Book Club Menu Good Books Book Worth Reading

Amazon Best Sellers Best Personal Taxes

Tax Free Wealth Book Summary Review